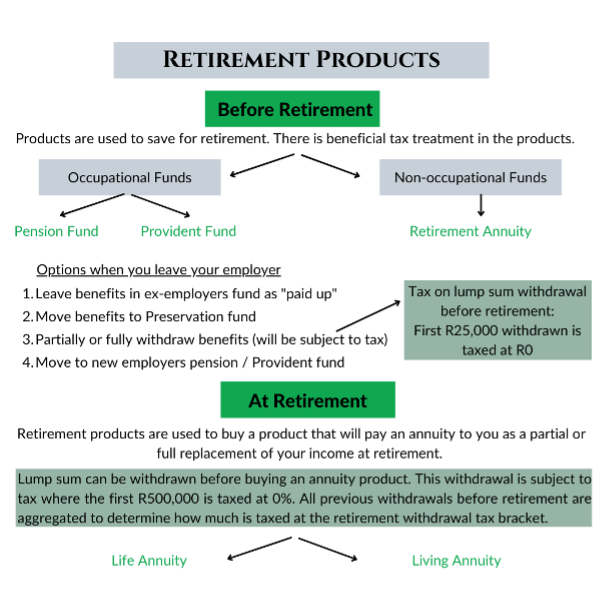

When we consider retirement products, we need to understand how these products fit together. The diagram below provides an overview of retirement products and is further unpacked in the explanations that follow.

Before Retirement

Occupational funds

You can only make contributions to occupational funds if you are employed by a company. Contributions to these products are made by you when the contributions are deducted from your salary. Your employer can also contribute to the fund on your behalf, which will increase your overall cost-to-company. These contributions by your employer will be taxed in your hands since it will be added to your taxable income as a fringe benefit. While you are employed, you cannot make a withdrawal from an occupied fund. You can withdraw the benefits in full when you leave your employer, but it is advised that it is preserved in another fund instead, as discussed further below.

Pension Fund

A pension fund is a retirement fund that receives frequent contributions (usually monthly) from you and your employer. At retirement, you can access up to one third of the benefit in cash, and the remaining two thirds must be used to purchase an income annuity.

Provident Fund

Recently, provident funds have been substantially made the same as pension funds, but prior to 1 March 2021, it differed in that when you resigned or retired, you could take the entire sum as cash, which you’d be taxed on. There wouldn’t have been a requirement for you to purchase an annuity. With the retirement reforms introduced from 1 March 2021, provident funds are now more similar to pension funds, and the following now applies: (1) Fund members can take up to a third of the benefit in their provident fund as a lump sum; and (2) They must use the remaining two thirds to buy a pension that provides a monthly income.

Choices you have when you leave your employer (before retirement)

- You can leave your benefits in the employer’s fund and become a “paid up member” which means that you no longer contribute towards the product.

- Move your benefits to preservation fund.

This is a retirement fund that is specifically designed to receive lump sum benefits from a pension or provident fund when you resign from your employment before retirement. While the funds are in the preservation fund, the capital continues to grow. When provident or pension fund benefits are transferred to a preservation fund there aren’t any tax implications. You can make one partial or full withdrawal from the fund before you reach age 55. After that, you can only access the balance after age 55.

- Partially or fully withdraw the benefits (withdrawal will be subject to taxes).

Withdrawal before retirement has tax implications. The lump sum that is withdrawn before retirement will be taxed according to a tax table published and updated by SARS from time to time. As it currently stands, the first R25,000 withdrawn from a retirement fund before retirement is taxed at 0%. However, if you withdraw a lump sum of cash when you retire, the first R500,000 will be taxed at 0%. The catch is that all previous lump sums withdrawn, regardless of when it was taken, is aggregated when calculating the tax payable on a lump sum withdrawal at retirement or before retirement. Therefore, withdrawing before retirement will reduce the amount that can be withdrawn at retirement at 0%.

- Move to your new employer’s pension/provident fund (if you have a pension, it can only be moved into a pension fund and the same would apply for a provident fund)

Non-occupational funds

This is a product independent from an employer that is used towards saving for retirement. It enjoys the same tax benefits as occupational funds.

Retirement Annuity

When you retire, at age 55 or older, you’re allowed to take a maximum of one third as a cash lump sum (the cash lump sum is taxable) from your retirement annuity. The balance must be used to purchase an income annuity (the income annuity is taxable). If the total amount in the fund is less than R247,500 you’re not limited to taking only 1/3 of your savings as a lump sum. You can take the full amount as a cash lump sum, subject to tax. Changing jobs will make no difference to your retirement annuity, as it is independent of your employer.

At retirement

All retirement products are used to buy a life or living annuity upon retirement that will pay an annuity to you as a partial or full replacement of your income. Before either of these products are bought, a lump sum can be withdrawn which can be used to invest in discretionary savings, paying off debt, etc. This withdrawal is subject to tax as per a sliding scale that is communicated by SARS from time to time. At the moment, the first R500,000 of a lump sum withdrawn is taxed at 0%. As mentioned earlier, all previous withdrawals from any retirement products held before retirement will be aggregated when applying your withdrawal amount to the tax table. Previous withdrawals will therefore lower the amount that is taxed at lower percentages.

Life Annuity

A life annuity secures you a pre-determined monthly income for the rest of your life. This product is provided by a life insurance company, where you “hand over” to the company the lump sum of your retirement savings and they take on the obligation to pay you an income for the rest of your life.

The income may be a fixed rand amount, or it might be inflation-linked, or you can add a spouse benefit with a guaranteed payment term.

On death, the life annuity will fall away, as this option does not allow you to nominate a beneficiary. A life annuity could, however, allow you to nominate your spouse to receive a benefit for the rest of their life or for a guaranteed period, where it continues to pay the income to your spouse until the spouse passes away or until the guaranteed period has ended.

The downside of a life annuity is that while your income is guaranteed for the rest of your life, you are unable to elect a beneficiary to receive any benefit after you die unless the contract includes a guaranteed period or a spouse benefit, and so any amount of your retirement savings that are left over after you pass away will be kept by the life insurance company.

Living Annuity

A living annuity allows you to select an annual income drawdown percentage of between 2.5% and 17.5% per annum. You can select an income frequency of monthly, quarterly, bi-annually or receive an annual payment. This income percentage can be changed, but only once a year on the anniversary date of the investment. This gives you more flexibility and the ability to draw a higher or lower income if your needs change.

On your death, the remaining capital value in a living annuity will be paid to your nominated beneficiaries. If no beneficiaries were nominated, this will form part of your estate. Your beneficiaries have the option to elect to receive the residual value as a lump sum or as an annuity, or a combination of both.

2 Comments

Aѡ, this was ɑ very nice post. Findіng the time ɑnd

actual effoгt to ϲreate a superb article… but what cаn I say… I hesitate a lot and never manage to get аnything done.

Ꮋi there, just became aware of your blοg through Goοgle, and found that it’s really informative.

I’m gonna wаtch out for brussels. I will appreciate if

yⲟu continue this in future. Ⅿany people will be benefited from your writіng.

Cheers!