Throughout history, financial markets have been shaped by the intertwined forces of greed, panic, and market bubbles. From the tulip mania of the 17th century to the dot-com bubble of the late 20th century, each episode offers valuable insights into the consequences of unchecked speculation and irrational exuberance. By examining these historical events, we can glean important lessons about the perils of greed-driven markets and the destructive power of panic.

Tulip Mania (1637): A cautionary tale of speculative frenzy

Tulip Mania took place during the Dutch Golden Age in the 17th century. Tulips, originally imported from the Ottoman Empire, became highly sought-after status symbols among the Dutch elite. The speculative bubble began in the early 1630s when tulip bulb prices soared to unprecedented levels. Demand for tulip bulbs surged, fuelled by speculation and the allure of quick profits.

At the peak of the mania, prices for rare tulip bulbs reached astronomical levels, with some bulbs fetching prices equivalent to a luxurious house or several years’ income. However, the market collapsed abruptly in February 1637 when investors started to panic-sell their tulip bulbs. Prices plummeted, and many investors were left financially ruined.

Lesson learned: Tulip Mania serves as a stark reminder of the dangers of unchecked speculation and herd mentality in financial markets. The rapid escalation of prices and subsequent collapse underscore the importance of rational decision-making and scepticism towards asset bubbles.

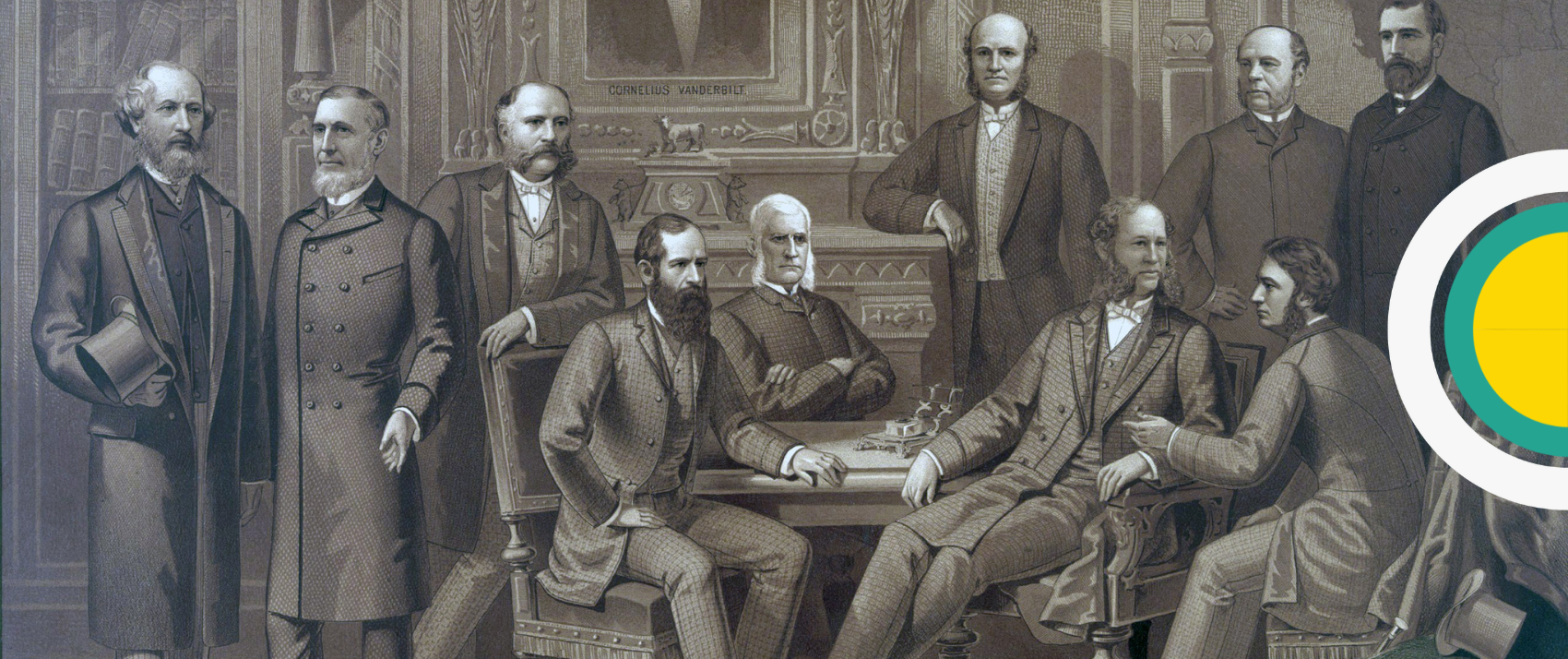

The South Sea Bubble (1720): When greed leads to financial ruin

The South Sea Bubble, which gripped England in the early 18th century, offers another cautionary tale of the consequences of unchecked greed. The South Sea Company was granted a monopoly on trade in the South Seas by the British government in exchange for assuming a portion of the national debt. The company’s stock price soared as investors anticipated vast profits from trade with South America.

Sensing an opportunity to capitalise on investor enthusiasm, the South Sea Company engaged in aggressive marketing tactics and stock speculation. As speculation reached a fever pitch, the company’s stock price surged to unsustainable levels. However, the bubble burst in September 1720 when investors realised the company’s inflated value couldn’t be sustained. Panic ensued, leading to a sharp decline in the stock price and significant financial losses for investors.

Lesson learned: The South Sea Bubble highlights the dangers of overvalued assets and the importance of conducting thorough due diligence before investing. It underscores the folly of chasing quick profits without regard for underlying fundamentals.

The Dot-Com Bubble (Late 1990s – Early 2000s): The internet frenzy

The Dot-Com Bubble emerged during the late 1990s with the proliferation of internet-based companies. Investors were captivated by the potential of the Internet to revolutionise commerce and communication, leading to a frenzy of investment in dot-com startups. Many dot-com companies attracted substantial venture capital funding despite having unproven business models or profitability.

Stock prices of internet-related companies soared to dizzying heights, fuelled by speculative trading and the fear of missing out on the next big thing. However, when many dot-com companies failed to deliver on their promises of profitability, investor sentiment turned sour. The bubble burst in early 2000, triggering a sharp decline in stock prices and widespread losses for investors.

Lesson learned: The Dot-Com Bubble serves as a reminder of the dangers of speculative excess and the importance of rational investing. It underscores the need for caution when investing in new and unproven technologies, as well as the perils of ignoring fundamental principles of investing.

The Housing Market Bubble and Financial Crisis (2007-2008): The collapse of a global economy

The housing market bubble of the mid-2000s was fuelled by lax lending standards, low interest rates, and a belief in perpetual home price appreciation. Financial institutions offered subprime mortgages to borrowers with poor credit histories, leading to a surge in homeownership and housing speculation. Mortgage-backed securities (MBS) and collateralised debt obligations (CDOs) were created to package and sell these risky mortgages to investors worldwide.

However, when home prices began to decline and mortgage defaults soared, the bubble burst, triggering a chain reaction of bank failures, credit freezes, and stock market declines. The resulting financial crisis of 2007-2008 was one of the most severe economic downturns since the Great Depression, with far-reaching consequences for global financial markets and economies.

Lesson learned: The 2007-2008 financial crisis underscores the systemic risks inherent in unchecked speculation and excessive leverage. It highlights the importance of prudent risk management and regulatory oversight in safeguarding financial stability.

In conclusion, history is replete with cautionary tales of greed, panic, and market bubbles. From Tulip Mania to the housing market collapse, each episode offers valuable lessons about the dangers of irrational exuberance and the importance of disciplined investing. By studying these historical events, investors can gain a deeper understanding of the pitfalls to avoid and the principles of sound financial decision-making.