Finance and technology, commonly referred to as FinTech, are key sectors undergoing a profound transformation. It is creating innovative solutions that enhance financial services. Besides, there is a high demand for professionals in this sector since it is significantly growing. As a result, an MBA in Financial Technology is emerging as a compelling option for aspiring leaders and innovators.

In this article, we explore the essentials of an MBA FinTech, including its benefits, curriculum, eligibility criteria, career prospects, and more. Whether you’re considering advancing your career in FinTech or curious about this advanced field, this comprehensive guide will provide you with all the information you need to make an informed decision. So, let’s begin.

Table of Contents

Understanding MBA in FinTech

There are countless MBA programmes in South Africa, but only a few focus on fintech, a rapidly growing sector that combines finance and technology. Hence, students who want to receive a postgraduate-level business management degree and know more about how technology is reshaping the finance world can find value in a Fintech MBA programme.

The MBA in Financial Technology programme focuses on key areas such as financial systems, data analytics, blockchain technology, cybersecurity, and the regulatory environment. With core subjects, an MBA FinTech prepares graduates to tackle modern financial challenges and drive innovation. Whether you aim to work in a traditional financial institution, a FinTech startup, or launch your own venture, this programme provides a comprehensive understanding of how technology is revolutionising the financial landscape.

Why Pursue an MBA in Financial Technology?

Considering an MBA in FinTech for your career offers many benefits. It equips you with a unique blend of financial expertise and technological skills, placing you at the forefront of the rapidly evolving FinTech industry. Hence, whether you aim to drive innovation in established financial institutions or start your own FinTech venture, this degree prepares you to excel in this dynamic and evolving field.

Following are the key reasons that show why you should pursue an MBA Fintech programme:

- Offers Career Opportunities: The FinTech sector is expanding rapidly, with startups and established financial institutions investing heavily in technological advancements. Pursuing an MBA FinTech places graduates at the forefront of this growth and offers numerous career opportunities.

- Provide In-Demand Skills: There is a significant demand for professionals who can blend financial expertise with technological knowledge. An MBA FinTech provides this unique combination, making graduates highly valuable in the job market and demanded by employers.

- Allows Career Flexibility: An MBA in FinTech opens doors to various roles, including financial analyst, product manager, risk manager, and more. In other words, the degree’s versatility paves the way for your career flexibility and growth.

- Drive Competitive Advantage: Holding an MBA FinTech distinguishes candidates in a competitive job market. This is because this programme prepares you to understand and employ technology to drive financial innovation, helping you gain a competitive advantage.

What can you expect from an MBA in Financial Technology?

An MBA FinTech offers a comprehensive exploration of modern financial systems, data analytics, blockchain technology, cybersecurity, and regulatory frameworks. As a result, this specialised programme equips you to innovate and lead in the finance and technology sectors.

- Well-Structured Curriculum:The curriculum of an MBA FinTech typically includes core MBA subjects such as finance, marketing, and management, along with specialised courses in FinTech. These may cover topics like blockchain, artificial intelligence, machine learning, data analytics, digital payments, and cybersecurity.

- Practical Experience: Most MBA programmes incorporate practical experiences, such as internships, capstone projects, and collaborations with FinTech companies. These hands-on opportunities allow students to apply what they have learned in real-world settings and build valuable industry connections.

- Networking Opportunities: Pursuing an MBA programme offers extensive networking opportunities through events, workshops, and alumni networks. These opportunities help you engage with peers, faculty, and industry professionals who can provide insights into the FinTech landscape and open doors to potential career prospects.

- Global Perspective: As mentioned earlier, fintech has a global impact, encouraging many MBA programmes to prioritise this global viewpoint. As a result, MBA FinTech involves understanding international markets, regulations, and technological trends.

Eligibility Criteria for MBA in Financial Technology

When you apply for the MBA Fintech programme, you must satisfy criteria that ensure you are eligible for it. As a result, applicants must hold a bachelor’s degree from an accredited university. This academic qualification lays the foundation for advanced business studies and showcases your ability to succeed in academic environments.

Additionally, most MBA programmes prefer candidates who have relevant work experience, typically ranging from two to five years. This requirement ensures that applicants bring practical knowledge and professional insights into the classroom, enriching the learning experience for themselves and their peers.

Furthermore, applicants are required to achieve a competitive score on an MBA entrance exam. Achieving a high score on these exams can strengthen your application by showcasing your success in the MBA programme.

Jobs After MBA in Financial Technology

After pursuing an MBA in FinTech, you can explore a wide range of career opportunities across several industries. This programme provides graduates with a combination of financial knowledge and technical skills, getting them ready for various career prospects. Besides, this programme offers a comprehensive understanding of concepts like blockchain, data analytics, cybersecurity, and financial systems, preparing learners for diverse job possibilities.

So, if you are keen on creating new financial products, studying market trends, or assisting companies with tech integration, an MBA in FinTech can lead to various fulfilling job roles like the following:

- Blockchain Developer

- FinTech Consultant

- Data Scientists

- Financial Analyst

- Product Manager

- Cybersecurity Analyst

- Risk Manager

- Regulatory Technology (RegTech) Specialist

- Investment Banking Associate

- E-commerce Manager

Conclusion

Enroling in an MBA programme focused on Financial Technology provides a unique educational opportunity for students since it combines financial knowledge with technological skills. Besides, as the FinTech industry continues to grow and innovate, professionals equipped with this unique skill set are in high demand. As a result, an MBA in Financial Technology prepares graduates to tackle modern financial challenges and drive innovation. With its strong foundation in financial systems, data analytics, blockchain technology and cybersecurity, graduates are well-prepared to lead the way and shape the future of finance.

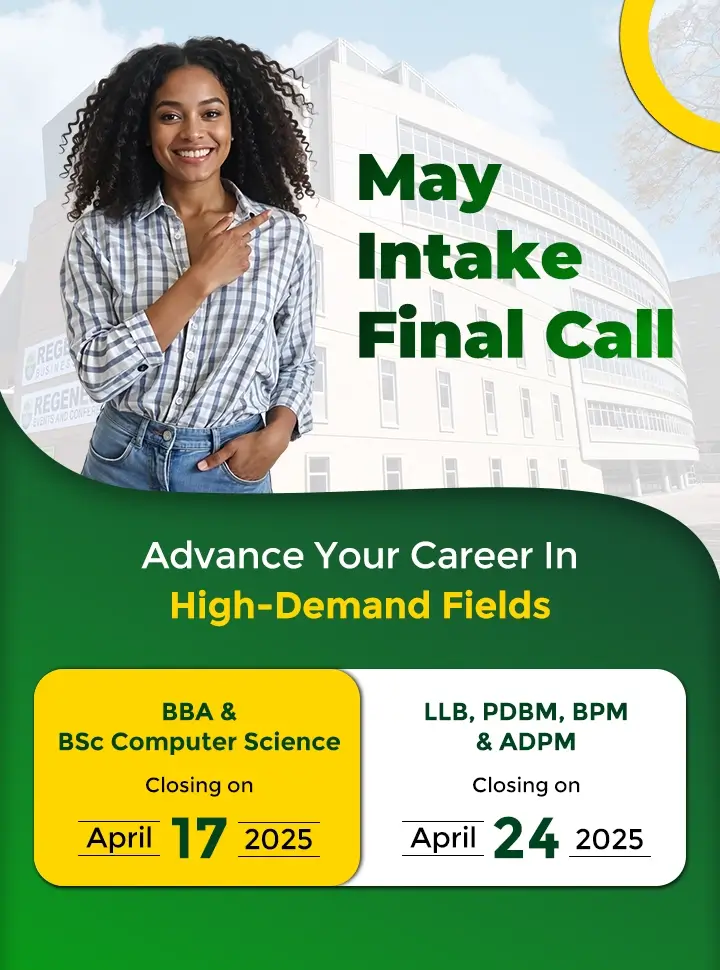

Are you looking for an MBA programme in South Africa? Regenesys Business School offers an MBA programme for students seeking to gain advanced knowledge and skills required to excel in the business world. You will get highly experienced instructors and industry experts to guide you for a successful career in business. Please note that Regenesys focuses exclusively on offering a traditional MBA programme and does not provide an MBA in FinTech Technology.

MBA in Financial Technology – FAQ’s

What is FinTech?

FinTech, or Financial Technology, refers to the integration of technology into financial services to create innovative solutions that enhance the efficiency, accessibility, and security of financial transactions and services.

Why should I pursue an MBA in FinTech?

An MBA FinTech provides a unique blend of financial knowledge and technological skills, preparing you for a wide range of career opportunities in a rapidly growing sector. It equips you to lead innovation and understand complex financial systems.

What are the key subjects covered in an MBA FinTech?

The key subjects in MBA FinTech typically include financial systems, data analytics, blockchain technology, cybersecurity, artificial intelligence, machine learning, digital payments, and regulatory frameworks.

What career opportunities are available after completing an MBA FinTech?

Graduates can pursue various roles, such as Blockchain Developer, FinTech Consultant, Data Scientist, Financial Analyst, and Product Manager. The degree’s versatility also opens doors to many other positions in the financial and technology sectors.

How does an MBA in Financial Technology provide a global perspective?

The programme covers international markets, regulatory environments, and technological trends, often offering study abroad options or partnerships with international institutions to provide a comprehensive global outlook.