Dying is not a concern for the dead but can become a living nightmare for the loved ones that are left behind. They can suffer financial stress, added emotional trauma and endless administration agony. Therefore, having your affairs in order could be a very important last act of kindness that you can give your loved ones.

If a person passes away, the assets and liabilities that they owned become known as their estate. The estate needs to be wound up by distributing the assets, settling outstanding debt and paying applicable taxes. An executor is responsible for winding up the estate and can be responsible for tasks such as collecting assets, legally transferring assets, liaising with the Master of the High Court, paying final taxes, and ensuring that any last wishes of the deceased are honoured, to name but a few. The Master of the High Court is the court’s representative who is responsible for overseeing the administration of the estate, care of minors and setting up a testamentary trust, if needed.

With some important terminology out of the way, let us dive into Part One of the reasons why it is important to plan for your death.

Avoid dying intestate

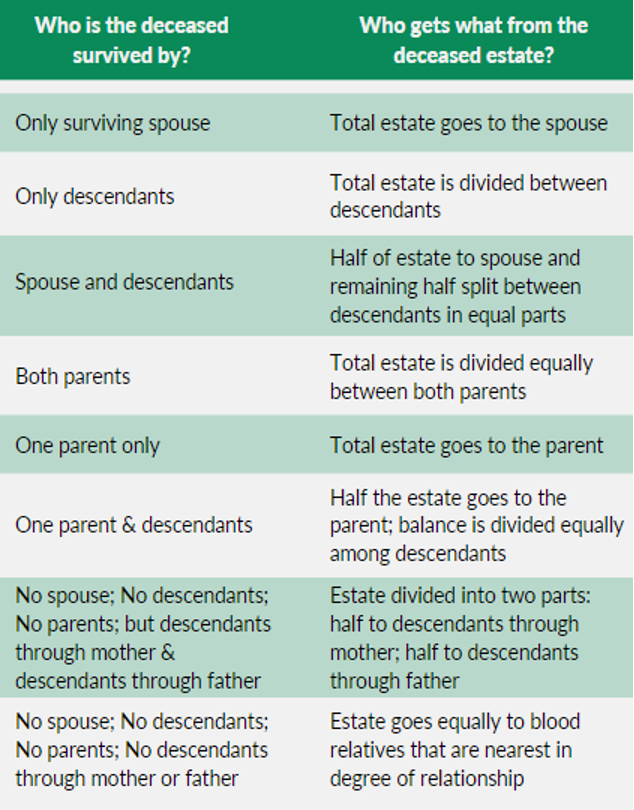

Dying ‘intestate’ is the formal phrase for referring to someone that passes away without a valid last will and testament, meaning that their estate will be distributed according to the laws of intestate succession as set out in the Intestate Succession Act of 1987. This law sets out a fixed formula that will be followed to distribute the assets in the estate. The risk associated with this is that a loved one that may be financially dependent on you, may not benefit adequately, or benefit at all, from such a distribution and people that you do not have a relationship with may benefit at the cost of other loved ones. The table below is a basic summary of this intestate ‘formula’:

Avoid dying intestate by drawing up and signing a valid last will and testament, and make sure to update it regularly as your circumstances change. This is the only way to have a say in how your estate should be distributed should you pass away.

Avoid dying intestate by drawing up and signing a valid last will and testament, and make sure to update it regularly as your circumstances change. This is the only way to have a say in how your estate should be distributed should you pass away.

You can nominate an executor in your will

The deceased can nominate an executor of their estate in their last will and testament. Alternatively, the Master of the High Court will appoint an executor of their choice and that may not have been the wishes of the deceased. Nominated executors do, however, have the right to decline the appointment and it is therefore important to nominate the appropriate person. A family member or friend or alternatively a professional can be nominated as the executor, but there are pros and cons to either. A professional will charge a fee for the administration while a friend or family member will probably perform this duty at no additional charge, but think carefully before trying to save a buck on executor’s fees. The process of winding up an estate can be an enormous burden on a loved one while they are going through a period of grieving. It can also be a demanding job requiring interaction with many different parties, adhering to many regulations and keeping up with specific timelines.

Should you wish to appoint a professional executor for the above reasons, they can ask a fee of up to 3.5% of the net value of the estate plus VAT, if they are registered for VAT. They are also entitled to up to 6% of any income received by the estate that they help collect and administer. These fees are the upper limits and it is important to know that they can be negotiated. Negotiating with a professional and having the agreed fee penned down in the will, before a person passes on, can improve the process and can ensure that the will gets wound up as quickly as possible. Although the fees can be negotiated after a person has passed on by their loved ones, it is often more difficult as there is less room for negotiating. It is therefore beneficial from a cost and time savings perspective to negotiate with and nominate an executor while still alive as it can help smooth out the process when the nominated executor needs to be presented to the Master of the High Court.

Also consider life policies on the life of the deceased that can be put in place and paid for with the goal of covering the executor’s fees. These policies are a great way to help ensure that the executor can carry on with their duties without the distress from loved ones to cover their fees.

Avoid family drama

This is somewhat self-explanatory but can’t be emphasised enough. The grieving process is a time filled with many emotions and everyone deals with it in their own way. No matter how close the relationship between relatives is or how level-headed loved ones left behind can be, during this period of grief, they often tend to be adamant on how they believe the best way is to honour the last wishes of a passed loved one, and their thoughts and opinions on this can often differ significantly. Unfortunately, some also act in greed and self-interest at the cost of other loved ones. By clearly stipulating your wishes in your last will, you can help loved ones focus on the grieving process rather than arguing about how to honour your last wishes or having someone take advantage of your passing.

A will is one of the most important documents you will sign in your life, and it is something that needs to be maintained to keep it up to date with your life’s changing circumstances. Draw up a will and plan to ensure your will is cost effective and that your estate will be distributed effectively. Part Two of this series will consider the role a will can play in ensuring that your minor children are adequately cared for and how to avoid liquidity problems due to your accounts being frozen when you die.