One of the most lucrative and rewarding careers you can pursue is a career in banking. Bankers the world over earn comparatively higher salaries than people in other professions. Popular opinion regards this as a good thing in that you do not want someone who is dealing with others’ money on a daily basis to be in want of money – it helps keep people honest.

THIS ARTICLE COVERS:

- Stepping stones into banking

- Identify your preferred niche

- Infinite opportunities for BBA degree holders

- A special skill needed in private banking

While organisations like the Institute of Bankers in South Africa offer various kinds of bank training courses, you can also become a banker with a Bachelor of Business Administration (BBA) or a Bachelor of Business Administration in Banking.

You can greatly improve your chances of being hired by a bank by following these three steps:

- Identify the area within the banking sector that you want to work for.

- Identify the modules within the banking courses linked to this area.

- Obtain high marks (preferably distinctions) in the modules identified in step 2.

Stepping stones into banking

Regenesys Business School offers three premier degrees you can use as a stepping stone into a career in banking:

- Bachelor of Business Administration

- Bachelor of Business Administration in Banking

- Bachelor of Business Administration in Retail Management

Although the Bachelor of Administration in Banking degree is geared specifically for people in the banking industry, this does not preclude holders of a Bachelor of Administration, or a Bachelor of Business Administration in Retail Management, from joining the banking sector, as banks are multifaceted organisations that require skills from various disciplines, such as human resources, finance, accounting, credit management, information technology and project management, to name a few.

Identify your preferred niche

As banks have become more complex and specialised to adapt to the ever-changing business environment of the modern economy, you will need to do a little research to identify the niche that you see yourself aiming for.

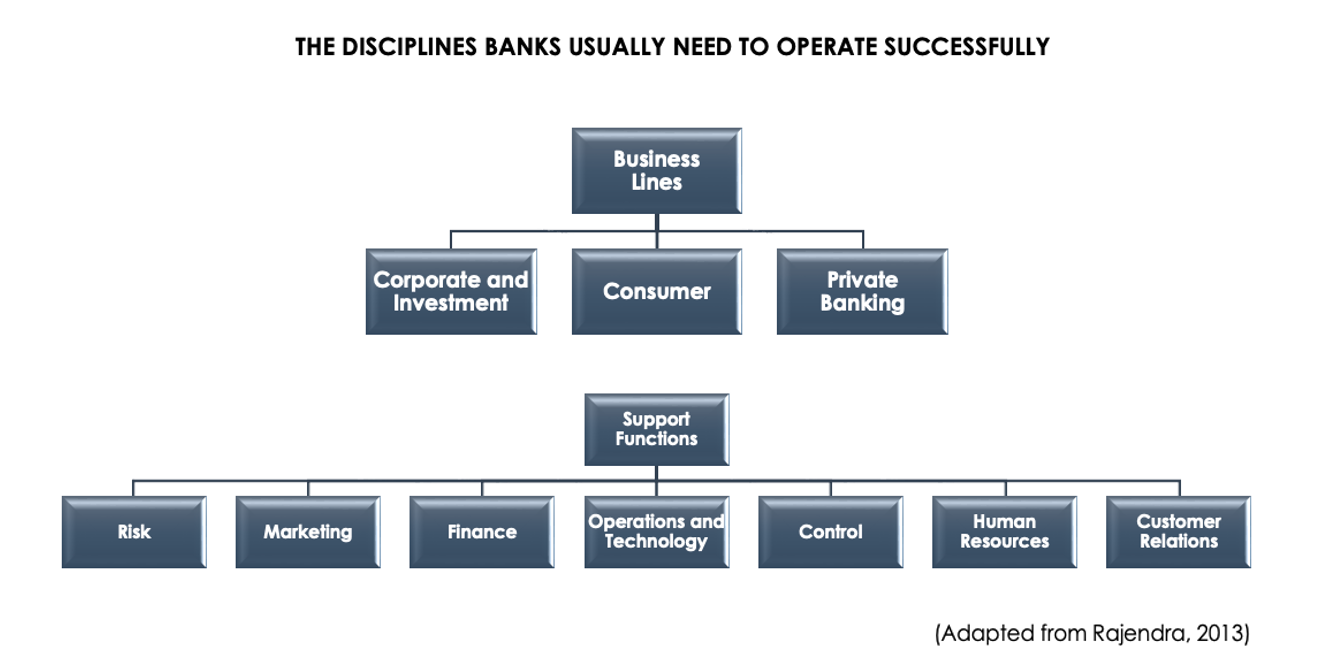

In the generic banking operation diagram above, the three main business lines of a traditional bank are represented: a corporate and investment arm, a consumer arm, and private banking.

In the generic banking operation diagram above, the three main business lines of a traditional bank are represented: a corporate and investment arm, a consumer arm, and private banking.

The corporate and investment arm deals with large organisations. You find areas like the treasury function housed under this unit. Big corporate deals like Elon Musk’s recent acquisition of Twitter would have been handled by this department. If you want to work in this part of a bank, your core subjects must include Economics and Finance.

Infinite opportunities for BBA degree holders

Consumer – or retail – banking is the arm of the bank that deals with individual customers. Most people will have interacted with this part of the bank. The opportunities here for BBA degree holders are infinite, as there are myriad departments you can join using the skills and knowledge gained from your BBA banking and finance modules.

The private banking section deals with high net worth individuals. Courses like Marketing and Finance can put you ahead of the curve should you wish to join this area of banking.

The support areas of a bank are usually the ones that are not customer-facing; here subjects like Information Technology, Human Resources, Finance, Accounting, and Credit Risk become critical.

Whichever area of banking piques your interest, you should not stop studying after graduating with a BBA degree. Life-long learning and upskilling will see you become an expert in your chosen department or field, ensuring that you contribute maximally to the value creation process.

A special skill needed in private banking

Note that areas like private banking require staff with exceptional levels of emotional intelligence. Should you study at Regenesys Business School, you will have the additional benefit of the school’s emphasis on developing emotional and spiritual intelligence, which have become increasingly important in the corporate world.

References

- Rajendra, R. (2013). The Handbook of Global Corporate Treasury. Wiley.

- Institute of Bankers in South Africa. (2022). To build professional capital for the banking industry.